Understanding Difficult Money Borrowing: Provider Offered and Their Uses

Hard money providing functions as a vital alternative for getting financing in realty transactions. It focuses on home worth over consumer credit report, using quick capital for various jobs. This method can be useful in details scenarios, but it likewise carries inherent dangers. Comprehending the subtleties of hard money financing is essential for possible consumers. What variables should one take into consideration before pursuing this option? The responses may expose surprising understandings into this unique financial landscape.

What Is Difficult Cash Loaning?

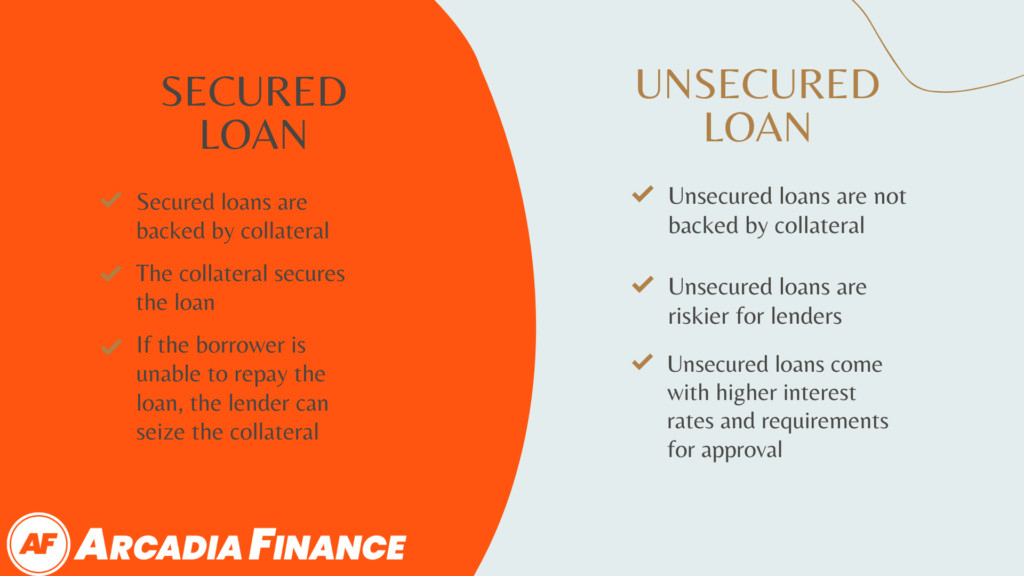

Hard money offering refers to a sort of funding where fundings are protected by realty instead of creditworthiness. This financing alternative is generally provided by private investors or companies, and it is frequently made use of in scenarios where typical loans are tough to get. The primary focus in tough cash loaning is the property itself, which works as collateral. Customers might look for tough money fundings for numerous factors, consisting of fast accessibility to funds genuine estate investments, recovery projects, or to avoid foreclosure. Due to the higher threat connected with these loans, passion prices often tend to be more than those of standard finances. The loan terms are usually shorter, typically ranging from a few months to a number of years. While difficult money lending can promote rapid financing, customers must be mindful about the terms to avoid possible economic risks.

Kinds Of Hard Cash Loans

The landscape of hard cash lending incorporates various sorts of finances customized to details needs. Residential tough money lendings satisfy individual property owners, while business tough cash car loans concentrate on company properties. In addition, bridge loan alternatives provide short-term funding remedies genuine estate transactions.

Residential Hard Cash Loans

While standard financing approaches might not match every debtor, residential hard cash finances supply an alternative for those seeking rapid financing genuine estate financial investments. These car loans are typically safeguarded by the residential or commercial property itself as opposed to the consumer's credit reliability, making them obtainable to people with less-than-perfect credit or urgent funding demands. Residential difficult money fundings are typically made use of for buying, refurbishing, or refinancing houses, especially by investor seeking to profit from market chances. With shorter terms and greater rates of interest, these fundings are designed for quick deals and can commonly be refined within days, allowing debtors to seize financial investment leads that may otherwise be unattainable via traditional loaning channels.

Business Hard Cash Car Loans

Industrial hard cash finances function as an essential financing option genuine estate capitalists and developers looking for quick funding for different industrial jobs. These lendings are normally safeguarded by the residential or commercial property itself, enabling lending institutions to supply financing based on the possession's value instead of the debtor's credit reliability. They are typically made use of for investing in, refinancing, or refurbishing commercial buildings such as workplace structures, retail spaces, and commercial centers. The authorization procedure is accelerated, enabling debtors to accessibility funds quickly, which is suitable for time-sensitive bargains. Although these finances included greater rates of interest and shorter repayment terms contrasted to conventional financing, they use adaptability and rate, making them a necessary tool for financiers steering competitive markets.

Bridge Loan Options

What options are offered for capitalists requiring prompt funding? Bridge funding functions as a vital service, offering quick accessibility to resources genuine estate transactions. This sort of difficult cash finance is typically temporary, developed to bridge the space between an instant monetary need and long-lasting financing. Investors can make use of swing loans for numerous purposes, consisting of obtaining buildings, funding restorations, or covering functional expenses throughout changes. These lendings frequently feature higher rates of interest and fees contrasted to standard funding, showing their expedited nature. In addition, swing loan can be safeguarded versus the home being funded or various other assets. This flexibility makes them an attractive choice for financiers seeking to profit from time-sensitive opportunities in the genuine estate market.

Trick Services Used by Hard Money Lenders

Tough money lending institutions offer a variety of essential services that deal with real estate investors and home developers seeking fast funding solutions. One key solution supplied is short-term loans, which are usually utilized for buying or remodeling properties. These financings normally have a quicker approval procedure compared to typical funding choices, enabling financiers to act promptly in affordable markets.Additionally, hard cash lenders may supply building and construction financings tailored for tasks needing substantial funding. This solution permits developers to protect the required capital to complete building tasks without comprehensive delays.Moreover, several difficult money loan providers give versatile terms, fitting different circumstances such as fix-and-flip projects or refinancing existing buildings. They likewise focus on the value of the property rather than the borrower's creditworthiness, making it obtainable for those with less-than-perfect credit report. These solutions collectively make it possible for financiers to take advantage of possibilities effectively and successfully in the realty market.

Benefits of Hard Cash Financing

Difficult cash offering deals several benefits that attract customers in need of instant financing. One crucial advantage is the quick accessibility to resources, allowing investors to take chances without extensive approval procedures. Additionally, the versatile funding terms commonly satisfy distinct financial situations, offering debtors with alternatives that conventional loan providers may not use.

Quick Accessibility to Resources

When time is of the essence, getting fast access to capital can be a game-changer genuine estate capitalists and entrepreneurs. Tough money providing supplies a streamlined procedure that typically enables consumers to protect funds in days instead of months or weeks. This quick turnaround can be vital when taking time-sensitive opportunities, such as contending image source or purchasing distressed residential or commercial properties in a competitive market. Furthermore, hard money loan providers typically require less documentation than typical banks, additionally speeding up the authorization procedure. The capability to quickly obtain funds makes it possible for investors to act emphatically, boosting their capacity for lucrative ventures. Eventually, this quick access to funding positions customers to take advantage of rewarding opportunities before they are lost to others in the marketplace.

Adaptable Lending Terms

For those seeking monetary remedies tailored to their certain demands, difficult money lending deals an unique advantage with its versatile lending terms. Unlike traditional lendings, which usually feature inflexible repayment schedules and stringent certification standards, difficult money fundings can be tailored to fit the borrower's distinct situations. Lenders may change rate of interest, financing period, and payment frameworks based on the possession's worth and the consumer's economic circumstance. This adaptability enables debtors to handle their cash flow better, providing to short-term jobs or financial investments. Additionally, the speed of approval and financing assists customers take time-sensitive opportunities, making difficult cash lending an appealing alternative for those calling for a much more customized strategy to financing.

Scenarios Where Difficult Cash Fundings Are Beneficial

In what scenarios might hard money financings prove helpful? These lendings are specifically beneficial genuine estate financiers that require fast financing to take financially rewarding chances, such as participating in or purchasing troubled residential properties property auctions. Standard lenders might not provide the essential speed or versatility, making difficult money car loans an attractive alternative.Additionally, individuals with bad credit rating might locate tough cash finances advantageous, as loan providers mostly assess the value of the security instead than the borrower's creditworthiness. This makes it much easier for those that might have problem with standard funding to protect funding.Furthermore, difficult cash loans can be important for temporary jobs, such as restorations or flips, permitting investors to profit from market trends swiftly. Customers requiring to shut offers swiftly, probably due to time-sensitive situations, typically turn to difficult cash fundings for their expedited authorization procedure.

The Application Process for Hard Cash Loans

Threats and Factors To Consider in Hard Money Financing

While hard cash offering offers quick access to resources, it additionally lugs considerable dangers and considerations that borrowers must thoroughly evaluate. One key problem is the high rate of interest usually related to these finances, typically ranging from 7% to 15%, which can strain a customer's funds. In addition, tough cash financings normally have shorter terms, frequently requiring settlement within one to three years, increasing the necessity for successful task completion or refinancing.The reliance on building as collateral positions an additional danger; if the consumer defaults, they could shed their possession. Furthermore, the absence of regulative oversight can lead to predative lending techniques, making it essential for debtors to thoroughly investigate lending institutions and comprehend financing terms. The unpredictability bordering residential or commercial property values might affect the debtor's capacity to repay, emphasizing the need for extensive economic planning and threat assessment prior to continuing with tough cash lending.

Frequently Asked Inquiries

Just How Do Interest Rates Compare to Traditional Car Loans?

Rate of interest rates for tough cash financings normally go beyond those of typical loans, mirroring the greater danger and much shorter terms included. This disparity can considerably influence total loaning expenses and repayment techniques for borrowers looking for fast funding solutions.

Can Hard Money Loans Be Used for Individual Costs?

Hard cash lendings are usually not planned for individual costs. Hard Money Lenders Atlanta. They are mainly utilized for actual estate investments, funding homes, or urgent resources requirements. Consumers need to take into consideration other alternatives for personal economic needs

What Happens if I Default on a Difficult Money Lending?

If a specific defaults on a difficult cash funding, the lender typically starts foreclosure procedures. This might cause the loss of the security property, influencing the debtor's credit score and monetary security substantially.

Are Hard Cash Lenders Managed by the Federal government?

Tough money loan providers typically operate outside traditional financial laws. While some see this site states apply certain guidelines, overall federal government oversight is limited, allowing loan providers substantial latitude in their procedures and car loan terms, which can influence consumer safety.

How Swiftly Can I Receive Funds From a Difficult Money Loan Provider?

The speed of fund disbursement from tough money lending institutions varies, but consumers typically obtain funds within days. This quick turnaround is due to the marginal documents and streamlined processes generally connected with hard cash lending. Residential tough cash fundings cater to private homeowners, while business hard money loans concentrate on organization homes. Hard Money Lenders Atlanta. These financings typically have a quicker authorization procedure contrasted check here to conventional financing choices, making it possible for investors to act swiftly in affordable markets.Additionally, tough cash lenders may supply construction fundings customized for tasks calling for considerable financing. Unlike standard loans, which often come with stiff payment schedules and stringent certification criteria, tough money fundings can be customized to fit the debtor's unique circumstances. Traditional lending institutions might not supply the essential speed or flexibility, making hard money loans an enticing alternative.Additionally, people with poor credit histories might discover tough cash lendings advantageous, as lending institutions largely analyze the value of the collateral rather than the consumer's creditworthiness. Rate of interest rates for difficult cash finances generally go beyond those of conventional finances, mirroring the greater risk and shorter terms involved